Super Updates + Timing your contributions

Click below to read the full report

Super contributions update

The publication of the Average Weekly Ordinary Time Earnings (AWOTE) earlier this week has resulted in a few modifications to the Super Contribution limits starting July 1, 2024.

In summary, these will be:

The standard concessional contribution cap will increase from $27,500 to $30,000.

Non-concessional contribution cap (NCC) will increase from $110,000 to $120,000.

The maximum NCC cap available under the bring-forward rule, will increase from $330,000 to $360,000*.

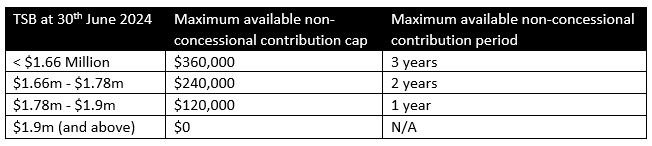

The total super balance (TSB) threshold used to determine the maximum amount of bring-forward NCC will be adjusted (see table below).

*If you have already triggered the bring-forward rule, you will not benefit from the increase in the NCC. The contribution level for the 2024-25 financial year will be limited to the amount you had previously locked in.

There are also a few other impacts to Super including:

The general transfer balance cap indexed to CPI has been confirmed as $1.9m for financial year 2024-25.

The Superannuation Guarantee rate will increase from 11% to 11.50% for financial year 2024-25.

Eligibility thresholds for Superannuation Government Co-contribution.

CGT Small business concession contributions cap (in relation to sale of eligible small business assets).

Low-Rate Cap (applies to tax treatment of superannuation withdrawals).

Superannuation Guarantee maximum contribution base.

As the financial year end draws near, it may be worthwhile checking if you have any unused concessional contributions that you can take advantage of. You can check these yourself via your MyGov account by linking it to the ATO or by contacting your fund administrator.

Timing your contributions

In our previous weekly we talked about how regular contributions add up in the long run, timing these entry points is a factor worth considering.

Below is a study conducted by Charles Schwab based on 5 imaginary long-term investors, each following different contribution strategies. Each start with $2,000 at the start of each year for 20 years ending 2022 and leave the funds in the share market, as represented by the S&P 500 Index.

Check out how they fared:

1) Perfect timer: As the name suggests had incredible skill (or luck) and was placed the $2,000 into the market every year at the lowest closing point. For example in 2003, rather than putting the $2,000 immediately into the market, it waited and invested on March 11, 2003—that year's lowest closing level for the S&P 500. Every year the investments were timed through to 2022.

2) Invest immediately: Each year, the cash is invested on the first trading day of the year.

3) Dollar cost average: Divided the annual $2,000 allotment into 12 equal portions, which were invested at the beginning of each month.

4) Bad timing: Incredibly poor timing—or perhaps terribly bad luck: Invested the $2,000 each year at the market's peak.

5) Stay in cash: Leaving money in cash investments (using Treasury bills as a proxy) every year, never investing in stocks at all.

Even bad timing fairs much better than no share market investments, demonstrating there is an opportunity cost in permanent procrastination. It is difficult to pick market bottoms on a regular basis, so realistically the best action that a long-term investor can take is to invest as soon as possible regardless of the current level of the stock market. If you don’t have the means to invest lumps sums all at once, dollar cost averaging is the next best option. Either way, don’t procrastinate, minimise regret, and avoid trying to time the market.

Source: Schwab Center for Financial Research.

Each individual invested $2,000 annually in a hypothetical portfolio that tracks the S&P 500® Index from 2003-2022.The individual who never bought stocks invested in a hypothetical portfolio that tracks the lbbotson U.S. 30-day Treasury Bill Index. Past performance is no guarantee of future results. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly. The examples are hypothetical and provided for illustrative purposes only. They are not intended to represent a specific investment product, and investors may not achieve similar results. Dividends and interest are assumed to have been reinvested, and the examples do not reflect the effects of taxes, expenses, or fees. Had fees, expenses, or taxes been considered, returns would have been substantially lower.

Side Note: The government's amendments to stage three tax cuts have passed the Senate. Click here to see our commentary.

It is important to note that historical returns are not an indicator or guarantee of future performance.

Please contact us on 03 9268 1118 or ahenderson@shawandpartners.com.au to discuss our services further.